Callan Associates updates a “periodic table” annually with the relative performance of 9 major asset classes over the last 20 years. Above is the most recent snapshot of 2006-2025, which you can find on their website Callan.com. The best performing asset class is listed at the top, and it sorts downward until you have the worst performing asset. I find it easiest to focus on a specific Asset Class (Color) and then visually noting how its relative performance bounces around.

The Callan Periodic Table of Investment Returns conveys the strong case for diversification across asset classes (stocks vs. bonds), capitalizations (large vs. small), and equity markets (U.S. vs. global ex-U.S.). The Table highlights the uncertainty inherent in all capital markets. Rankings change every year. Also noteworthy is the difference between absolute and relative performance, as returns for the top-performing asset class span a wide range over the past 20 years.

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

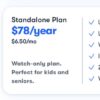

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)