Speaking of internal frugality, I’d say one of the most basic ways to save on rent or mortgage payments is to… live in a smaller place. No, wait, really. Let’s think about it.

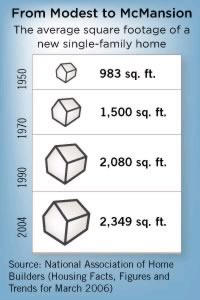

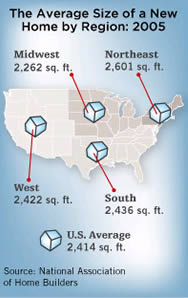

Even though it’s now easy to make fun of 10,000 square feet McMansions, they are only a side effect of an overall trend towards larger houses. According to this 2006 NPR article, the size of new houses has more than doubled since the 1950s. The average new home sold in 2007 was a whopping 2,629 square feet.

I know we’re getting fatter and need a bit more space to move around, but not by that much! In fact, the average family size has actually been decreasing over time. Here are some stats I pulled from the U.S. Census:

Source: U.S. Census Bureau

From 1970 to 2004, the average household shrunk by 27%, but the average square footage grew by 66%. Using median numbers gave similar results.

There are several theories as to why this is happening. For starters, we may simply want a higher standard of living. (Sharing bathrooms? That’s for people in 3rd-world countries!) Perhaps it’s from us continually one-upping our neighbors. Maybe builders are pushing bigger homes through marketing. Or it may be a result of the breaking up of the American family, and how we don’t like spending time together anymore.

Most importantly, we don’t need the extra space. If a family of four could live well in 1,500 square feet back in 1950, there is no real reason they can’t do so today. It’s just a choice like any other, and we have to examine whether it is really worth the price. In cities like New York, Tokyo, or Hong Kong where space is at a great premium, families have long adapted to much smaller living spaces.

Finally, the extra costs don’t stop with the bigger sticker price. There’s the higher property taxes and insurance rates. A bigger home costs more to heat, cool, maintain, and repair. More rooms means more furniture, more wall decorations, more room for clothes, and just more stuff in general. More appliances mean more electricity used. The list goes on and on.

In my opinion, many people don’t even notice that they are stretching to buy homes that just keep getting bigger and bigger. They just follow the crowd. It’s hard to be different. This unconscious choice may partially explain why many of us feel so much more stressed financially than our parents.

Update: After the housing bust, there has been a growing counter-culture celebrating living well in smaller places. There is even the extreme end of buying tiny houses and the small house movement. We may not need to all live in 300 sf houses, but it’s good to explore our options.

This post has been added to my Expense Reduction Guide: Housing.

Have you

Have you

One of my overall goals for 2012 is to make this site more of a permanent resource for information. As part of this, I want to create an “Expense Reduction Guide” that will provide an organized way to find ways to maximize personal value and make your spending efficient.

One of my overall goals for 2012 is to make this site more of a permanent resource for information. As part of this, I want to create an “Expense Reduction Guide” that will provide an organized way to find ways to maximize personal value and make your spending efficient. The Daily Beast has an article

The Daily Beast has an article

If you’re the person in your family or circle of friends that always seems to be asked computer questions, or are simply the person asking for help, what you really need is software that allows remote access between computers. That way, you can diagnose and fix problems from across the country without having to leave your desk.

If you’re the person in your family or circle of friends that always seems to be asked computer questions, or are simply the person asking for help, what you really need is software that allows remote access between computers. That way, you can diagnose and fix problems from across the country without having to leave your desk.

Updated with current price quotes for 2012!

Updated with current price quotes for 2012!

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)