Thinking about simplifying your life and living in less space? Perhaps you already live in a small space. If you haven’t heard of Resource Furniture, you should definitely check out this video of space-saving and transforming furniture from their store in New York City, land of the 250 sf studio. These are way beyond your standard Murphy beds.

I love the innovation here, although I have a feeling this stuff comes at a relatively steep premium. Their website doesn’t show prices (must ask for quote), but I’ve read around $8,000 for a bed/sofa combo. I wonder how long it will take to these designs to trickle down to mass market stores. Via Reddit.

It’s official: Experiences make people happier than possessions. Okay, not really, but it is the conclusion taken from a recent psychology study as reported in this

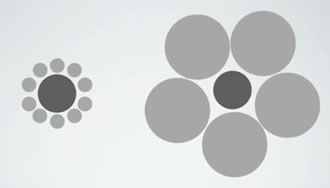

It’s official: Experiences make people happier than possessions. Okay, not really, but it is the conclusion taken from a recent psychology study as reported in this  You may be familiar with

You may be familiar with  While flipping through old magazines at the Doc’s office, I read about a site called Blippy.com in a

While flipping through old magazines at the Doc’s office, I read about a site called Blippy.com in a

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)