I am trying to gain more control over my diet, while also compiling more easy (preferably really easy) yet tasty recipes. First up is making my own lunch. I think it’s important when brown-bagging to make it tasty and attractive, so you don’t actually feel like your depriving yourself. Don’t just slap a sliver of cheap meat on some Wonderbread. Instead, you should take advantage that you are making the meal yourself. Put anchovies on the thing if you want.

In order to minimize the overall prep time, I bought all the ingredients at our usual grocery store (Safeway) during our usual shopping trip. Prices are actual prices, I bought regardless of if it was on sale or not. I also took into account the inevitable bit of extra waste from perishable ingredients like wilted lettuce or moldy bread, by including total package costs.

Shopping List

Sandwich

$2.50 for 1 loaf of 12-grain Oroweat bread (18 slices)

$5.25 for 3/4 lb of Black Forest Ham, thinly shaved from deli*

$1.75 for 1/4 pound of pepper jack cheese, thinly sliced

$1.75 for 1 large tomato, cut into 10 thin slices

$1.49 for 1 head of iceberg lettuce

$0.25 (est.) for pantry item Honey Mustard (1 bottle is $2.25)

—————-

$12.99 total, $2.60 per day

* You could buy smaller amounts of different meats like turkey breast, if you wanted to mix it up. When I feel like eating vegetarian, I buy a tub of hummus instead of meat.

** If you bought things on sale, or actually shopped around, you can probably reduce these prices by 20-40%.

Snack

This is estimated at $.30 cents per day. You could make it less by buying in bulk and packaging yourself, but the savings started getting small so I just went for simplicity. Examples:

$0.27 for single-serving assorted potato/tortilla chips ($6.49/24 bags)

$0.30 for baby carrots (split a 1 pound bag 5 ways, $1.50/lb)

$0.42 for a 100-calorie-pack of crackers. ($2.50/6 bag box)

Drink

Tap water is free, but I like drinking a Diet Coke for both leaving a sweet aftertaste and the extra bit of caffeine. If I didn’t already buy it previously on sale, this would have cost $.50 per can.

Preparation and Time Spent

Not much prep for the sandwiches. I just had to cut the tomato, peel off the lettuce, and then portion everything out into 10 reusable plastic containers (2 per weekday). I have one container for the bread, and one container for all the wet ingredients. I put a dab of mustard in between the ham and cheese. The separation keeps the bread from being soggy before eating. If I’m not lazy I toast the bread.

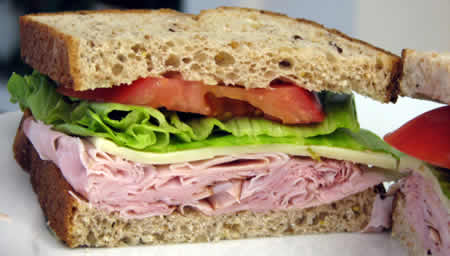

Packing all the materials for the entire week took less than half an hour. Actual photo of final product at the top of this post. Doesn’t it look like something worth eating for lunch?

Total Cost

The sandwich and snack combo costs a little under $3. This is actually more than I thought it would cost, although I think it’s relatively healthy when I eat it with carrot sticks (which I usually do with a dab of fat-free salad dressing). If eating out for lunch would have cost $6 per day, then that half hour on Sunday saved me $3 x 5 days = $15. $30 an hour post-tax is like earning $60 an hour pre-tax, so that’s pretty good. On top of that, I have the power to eat healthier and control what I consume.

Sure, if I consciously chose to work an extra 2 hours a month to “pay” for eating out, I could use my time that way instead. But if I’m honest with myself, lunch-making just takes a half hour that would have been spent goofing around on the internet before bed.

Clever Dudette has more frugal lunch ideas. Do you have your own tasty buy convenient lunch routines? For next week, I am thinking of making it the Fried Rice edition.

You may be expecting a review of the new online service

You may be expecting a review of the new online service  After months of being stuck in the day-to-day issues of buying a house, moving, and work, I spent a lot of time today… daydreaming! Mainly because I am getting tired of only having 2-3 weeks of vacation per year, I went back to thinking about how early I can achieve financial freedom. Let’s say I really want to retire in 10 years by age 40. What do I need to do?

After months of being stuck in the day-to-day issues of buying a house, moving, and work, I spent a lot of time today… daydreaming! Mainly because I am getting tired of only having 2-3 weeks of vacation per year, I went back to thinking about how early I can achieve financial freedom. Let’s say I really want to retire in 10 years by age 40. What do I need to do?  Now that we have our own home and backyard patio, we decided to buy our first propane grill and invite some people over. We had to schedule a convenient time to have my father-in-law come drive down with us since he has a truck, so we had pretty much decided to just buy whatever was cheap and in stock. No hours of research this time! Although some of our serious grilling friends told us to buy a high quality $400+ model, which is probably good advice, we really just wanted something simple to start out with. If we grilled often enough, then later we could upgrade to something that would last a long time.

Now that we have our own home and backyard patio, we decided to buy our first propane grill and invite some people over. We had to schedule a convenient time to have my father-in-law come drive down with us since he has a truck, so we had pretty much decided to just buy whatever was cheap and in stock. No hours of research this time! Although some of our serious grilling friends told us to buy a high quality $400+ model, which is probably good advice, we really just wanted something simple to start out with. If we grilled often enough, then later we could upgrade to something that would last a long time. We had our eye on a $199 Brinkmann grill with some decent BTU, grill space, and also shelf space. But when we got there, they were cleaned out except for one last box that was definitely a previous return. The box was opened, slightly ripped, and had the words “Returned – Missing Parts, Send to Dept #18577” scrawled on the side with permanent marker. It had no special price tag.

We had our eye on a $199 Brinkmann grill with some decent BTU, grill space, and also shelf space. But when we got there, they were cleaned out except for one last box that was definitely a previous return. The box was opened, slightly ripped, and had the words “Returned – Missing Parts, Send to Dept #18577” scrawled on the side with permanent marker. It had no special price tag. Now that we have a fixed monthly mortgage payment for the foreseeable future, we are looking ahead to our true mid-term goal of

Now that we have a fixed monthly mortgage payment for the foreseeable future, we are looking ahead to our true mid-term goal of  Last month one of our credit card statements spanned two pages because we had eaten out so often. Not only is it more expensive, I’m pretty sure it’s less healthy. So now we’re trying to limit ourselves to 2-3 times a week (minus the cafeteria at work), and making one of our outings to a new restaurant that we haven’t tried before.

Last month one of our credit card statements spanned two pages because we had eaten out so often. Not only is it more expensive, I’m pretty sure it’s less healthy. So now we’re trying to limit ourselves to 2-3 times a week (minus the cafeteria at work), and making one of our outings to a new restaurant that we haven’t tried before.  I’m sure the foodies already know about this site, but I just learned about it recently so I figured I’d throw it out there for discussion…

I’m sure the foodies already know about this site, but I just learned about it recently so I figured I’d throw it out there for discussion…  I’ve already shared my habit of

I’ve already shared my habit of  With the explosion of sites like Flickr, it seems like everyone is an amateur photography nut. I know I’ve talked about getting a SLR and taking a photography classes for oh… a decade?! Well, why not partake in a free online photography class this weekend. Photography 101: 12 Weeks To Better Photos includes everything from a course outline, weekly handouts, “homework” challenges, and a discussion group. I think they are currently in Week 6, although you can still jump in:

With the explosion of sites like Flickr, it seems like everyone is an amateur photography nut. I know I’ve talked about getting a SLR and taking a photography classes for oh… a decade?! Well, why not partake in a free online photography class this weekend. Photography 101: 12 Weeks To Better Photos includes everything from a course outline, weekly handouts, “homework” challenges, and a discussion group. I think they are currently in Week 6, although you can still jump in: The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)